- August 1, 2017

- Posted by: VatMan

- Category: Press Room

Article published by and copyright of KhaleejTimes.com

The Law defines a clear set of common procedures and rules to be applied to all tax laws in the UAE, namely, VAT and excise tax laws, and clearly states the respective rights and obligations of the FTA and the taxpayer

The President, His Highness Sheikh Khalifa bin Zayed Al Nahyan, has issued the landmark Federal Law No. 7 of 2017 for Tax Procedures, which sets the foundations for the planned UAE tax system, regulating the administration and collection of taxes and clearly defining the role of the Federal Tax Authority, FTA.

“The Tax Procedures Law is a significant milestone towards establishing the UAE’s tax system and diversifying the economy,” said Sheikh Hamdan bin Rashid Al Maktoum, Deputy Ruler of Dubai, UAE Minister of Finance and FTA Chairman.

“The Law, issued by The President His Highness Sheikh Khalifa bin Zayed Al Nahyan is an all-encompassing legislative framework that lays the groundwork for the UAE’s plan to implement taxes as a means to ensure sustainability and diversify the government’s revenue streams. The increased resources will enable the Government to maintain the momentum of its development and infrastructure for a better future.”

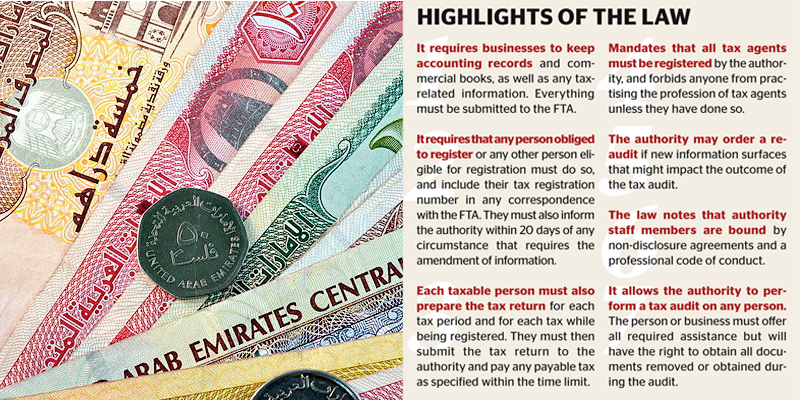

The Law defines a clear set of common procedures and rules to be applied to all tax laws in the UAE, namely, VAT and excise tax laws, and clearly states the respective rights and obligations of the FTA and the taxpayer.

The Law covers tax procedures, audits, objections, refunds, collection, and obligations – which include tax registration, tax-return preparation, submissions, payment and voluntary disclosure rules – in addition to tax evasion and general provisions.

When the Tax Procedures Law goes into effect, all UAE-based businesses will be required to keep accurate records for five years. The law also sets penalties for…