What is VAT?

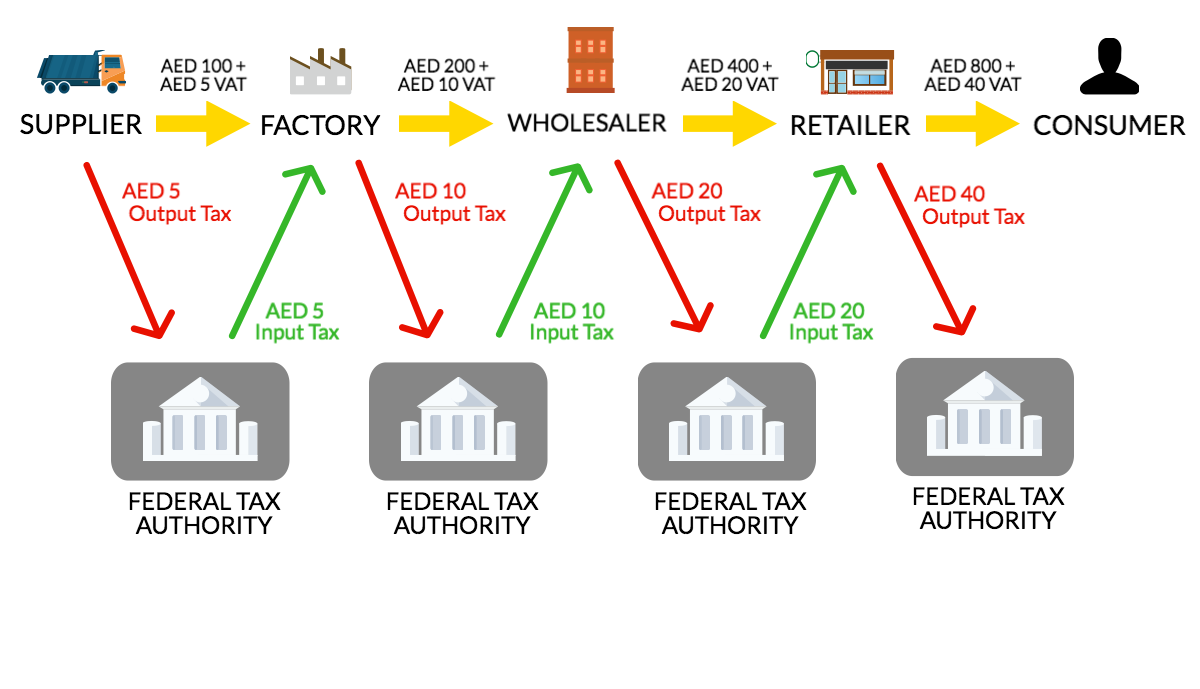

Value Added Tax (VAT) is an indirect tax on consumer expenditure and is collected on business transactions and imports. The businesses are effectively tax collectors on behalf of the government, collecting and submitting tax at each stage in the supply of goods and services until, ultimately, the full tax is borne by the end consumer.

How does VAT work?

Once a business is VAT-registered it must do three things:

- It must charge VAT – currently 5% – on the goods or services it sells to customers and other businesses;

- It must pay VAT on the goods and services it buys from other businesses; and

- It must file a VAT return every quarter to the tax authority – in the UAE, the Federal Tax Authority (FTA)

The general concept is that the VAT businesses charge and the VAT businesses pay roughly balances out – any difference is sorted out via the business VAT return, with either a payment to the tax authority of the amount owed to them or through a refund to the business for the amount owed by the tax authority.

For more information on VAT and its impact on your business, contact our team today.